Housing mortgages and homeownership costs have skyrocketed throughout the years, leading to higher consumer demand and low supply. The housing crisis affects individuals, families and communities, particularly in rapidly urbanizing regions near the Triangle area. Experts say that understanding the foundational causes of the housing issue as well as its implications and possible solutions can result in a more resilient economy.

Supply and demand imbalance is one of the leading causes of the housing crisis. Population growth and rapid urbanization are leading to housing shortages and inflated prices. According to Mortgage Reports, benchmark interest rates have risen 5% since rate hikes starting in 2022.

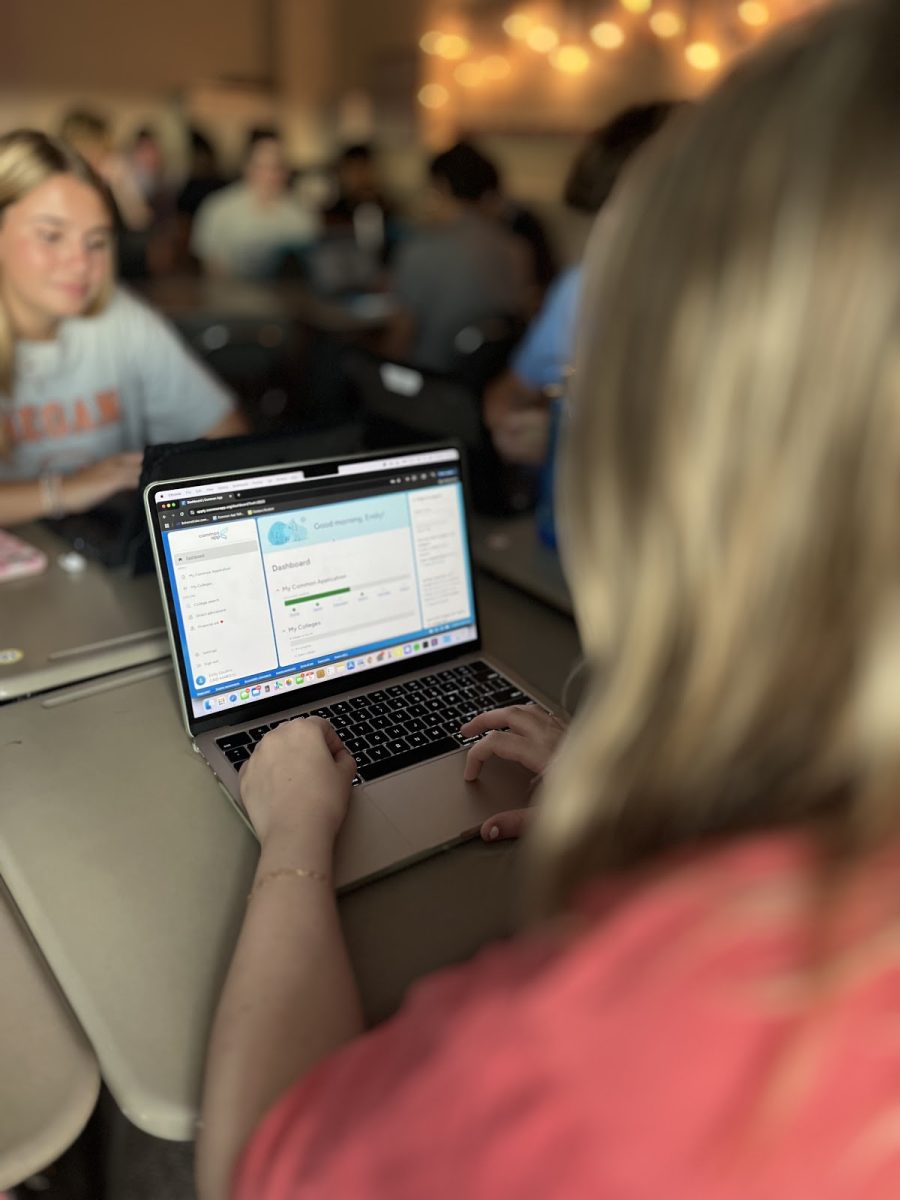

Individuals in Cary who are looking to buy their first home are now reconsidering such an option due to the lack of affordable housing options, particularly in neighborhoods with high demand for space — like in Cary.

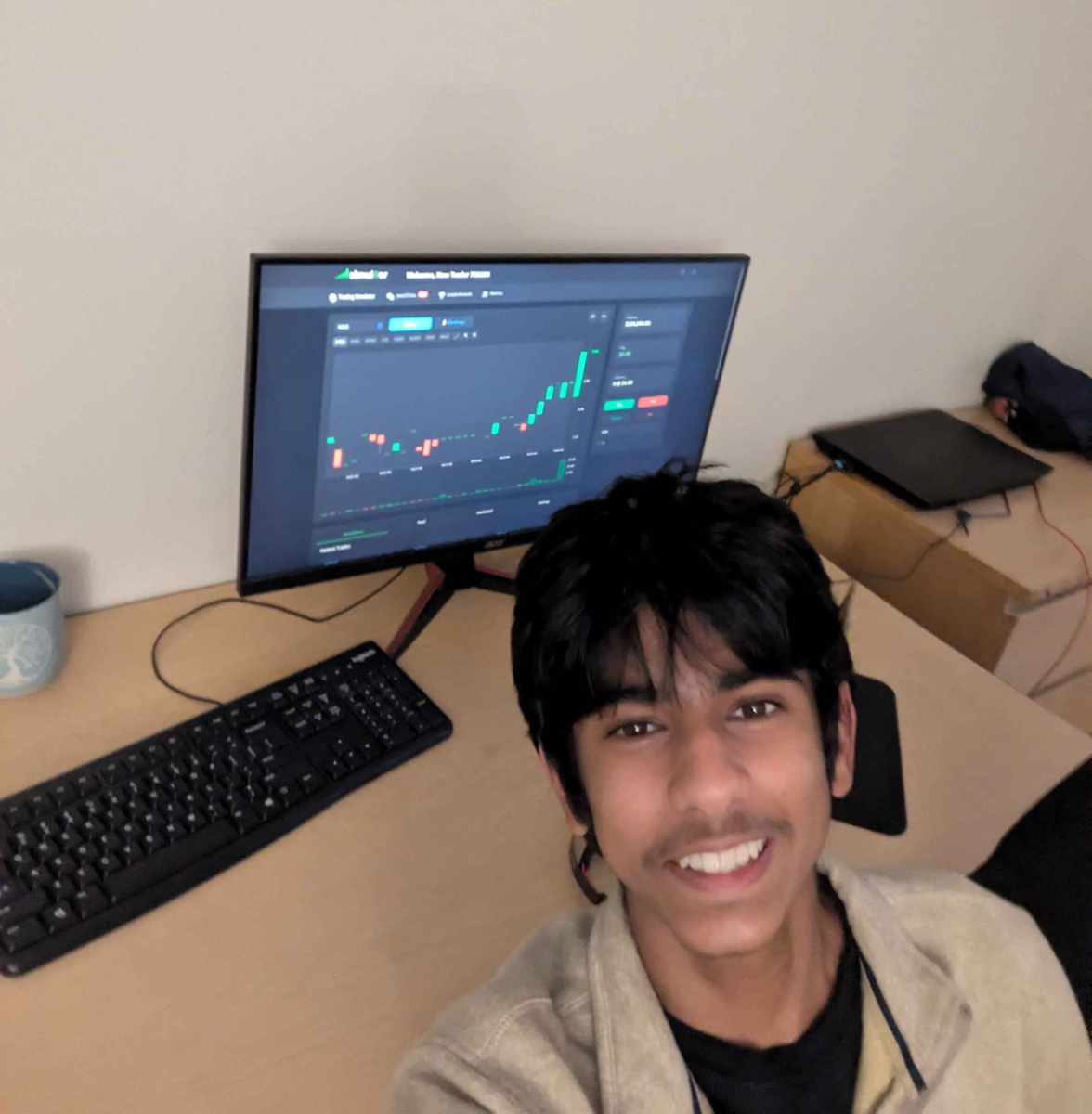

Green Hope student Rafik Khismatov (‘24) touched upon how moving into a new apartment was a difficult process in this current state of the economy. “Moving into a new apartment was definitely different from 10 years ago. Interest rates have gone up, as well as rent payments making our family budget our money carefully. I remember as a kid how our rent was way cheaper and now inflation caused it to go up by 40.7 percent,” he said.

High housing costs can financially strain families, leading to debt accumulation and financial insecurity. Another Green Hope student, David Molina (‘24), shared his experience on how his family handled the housing issues in Cary. “Moving from Charlotte to Cary, our family started by researching affordable housing options. Once we found a home in our budget, we decided to seek out government assistance programs and also decided to cut down costs on other things that we don’t need,” he said.

The housing crisis can have a noticeable impact on communities, as families are forced to relocate from foreclosure, causing certain individuals to struggle to afford paying for their homes.