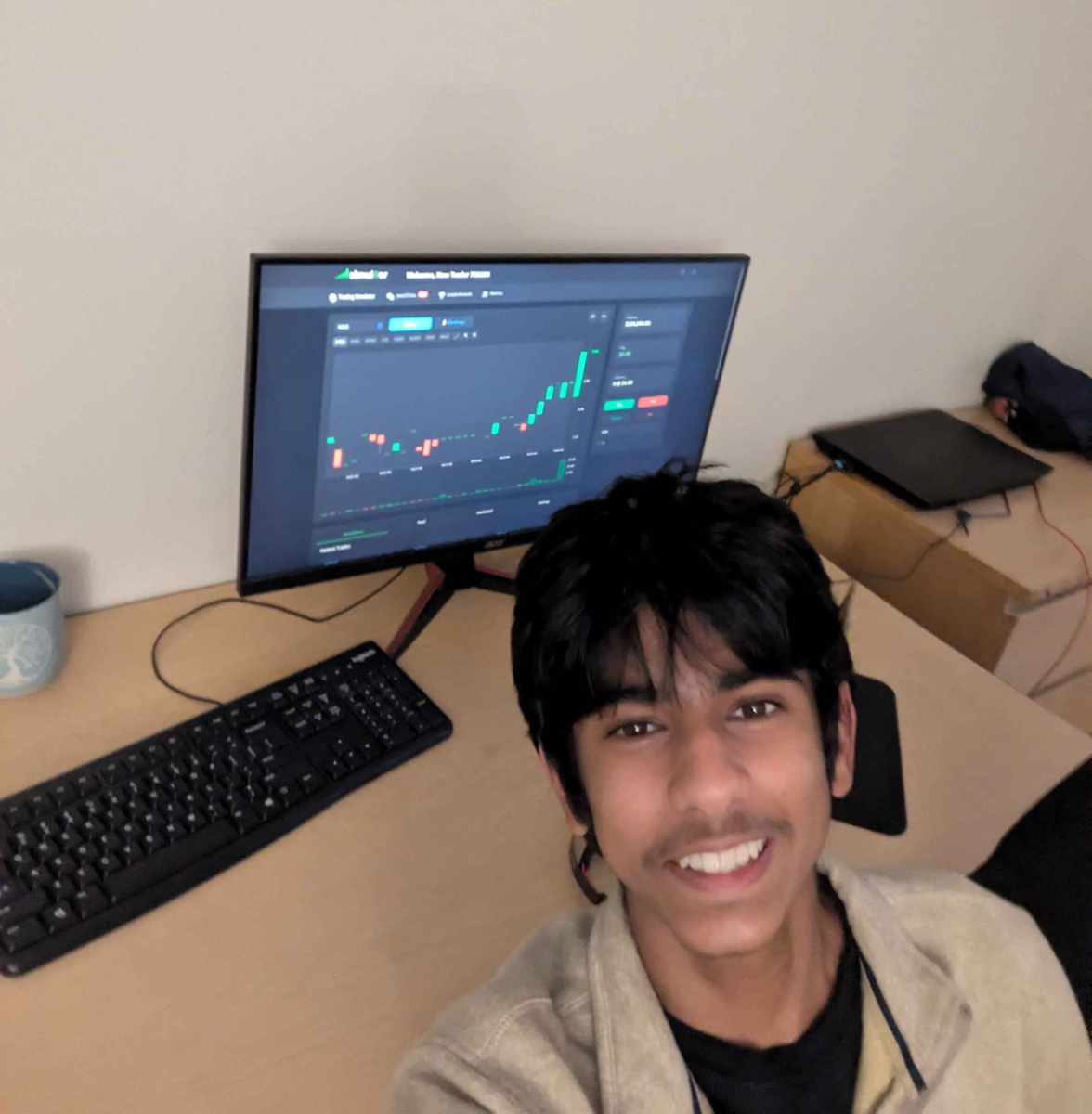

A multitude of apps that grant an underaged audience the ability to invest in stocks and contribute money to their personal funds have emerged to address the growing number of youths interested in saving for the future. Although the majority of these apps require a parent or guardian to have an account first, some allow for the child to take control as long as a parent’s name and credentials are listed on the account. The GH Falcon has created a list of five apps that minors can use to begin learning to save and invest.

Acorns Early

Acorns, a company that specializes in investing advice, created the Acorns Early app to allow parents to set up investment accounts for their children. Children can gain ownership of the account once they reach the legal age for their state. This allows for minors to co-invest and learn more about money management with the help of an adult. The family plan is $5.00 per month and includes the ability to invest spare change from everyday purchases and a service that can set aside pre-planned amounts from one’s paycheck to contribute to investments. Unlike other investment apps that only allow for College 529 plans, Acorns Early gives adults the ability to separate fundings into multiple categories that could later assist their child. For example, a parent can set up a fund for a new car or other substantial purchase.

Stockpile

Stockpile is an interface that allows users under the age of 18 to invest in stock, cryptocurrency and fractional shares. For $4.95 each month, an adult can sign up five children or less to use the app’s services. There are no age restrictions with Stockpile as long as the account has been made under an adult. The head of the account can use Stockpile gift cards to grant money to children that can be used to buy shares. All purchases using a Stockpile account must go through parental approval before a purchase is complete.

Greenlight

Greenlight offers materials for adolescents to learn about stocks while gaining real experience with the help of their parents. Teens can choose to buy stocks and research them all inside of the app before submitting their purchase with parental approval. Greenlight allows users to buy fractional stocks of companies. This means that users can buy into companies even if they do not have the funds to buy full shares of the stock. Greenlight also offers a debit card service which can be managed by an adult. The cost to access Greenlight’s amenities is $9.98 per month.

Busykid

The Busykid app is the perfect app for parents that are trying to teach their kids to save while integrating allowances and chores. The app comes with a chore chart that can be modified at any time. Based on the number of chores completed a pre-planned amount can be placed into the funds for investing or into their allowance. The app costs $3.99 per month and allows for up to five children on one account. Like Greenlight, Busykid also has a debit card service. Parents are able to put money into their child’s account and separate it into sections such as money to save or money to spend.

Fidelity Youth

Fidelity Youth allows for teens to make their own trading decisions and contributions without parental approval. Parents are still able to access the account and receive updates and notifications on what their children are doing, but the main controls are in the hands of the user. Users must already have an open Fidelity bank account, but teens who create their own accounts will receive a $50 bonus for opening. This app is free as long as one has a Fidelity bank account.