The number of first-time home buyers is rapidly falling as of late. In 2025, the average percentage of first-time homebuyers on the market share dropped from 32% to 24% in a year, based on a report provided by the National Association of Realtors (NAR). The average market share percentage is around 40%, with the highest it’s ever been topping at 50% in 2020. There are a number of reasons for the average share dropping, such as increasing house prices, inflation, and a smaller supply of available units. The Research Triangle area of North Carolina in particular has seen the number of first-time home buyers drop in recent years.

The GH Falcon discussed this trend with Kandyce Kindell, a realtor of four years who works in the Triangle. She has observed a decrease in the number of first-time home buyers firsthand and attributes it to increasing worries about being able to make ends meet. She explained how, “Buying a home is a large, important financial commitment, so if buyers are worried about job security, inflation, or anything that affects their ability to make their monthly payments, people would naturally be hesitant to make the purchase.” One of the main reasons for concern about buying a house is the cost.

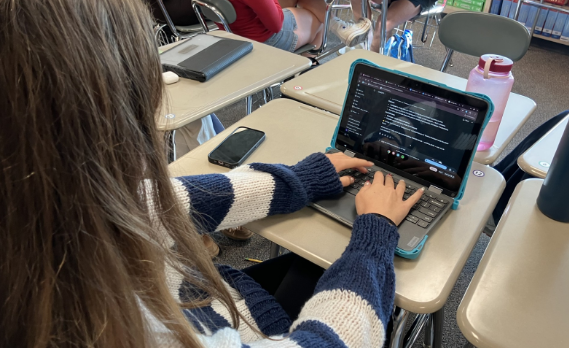

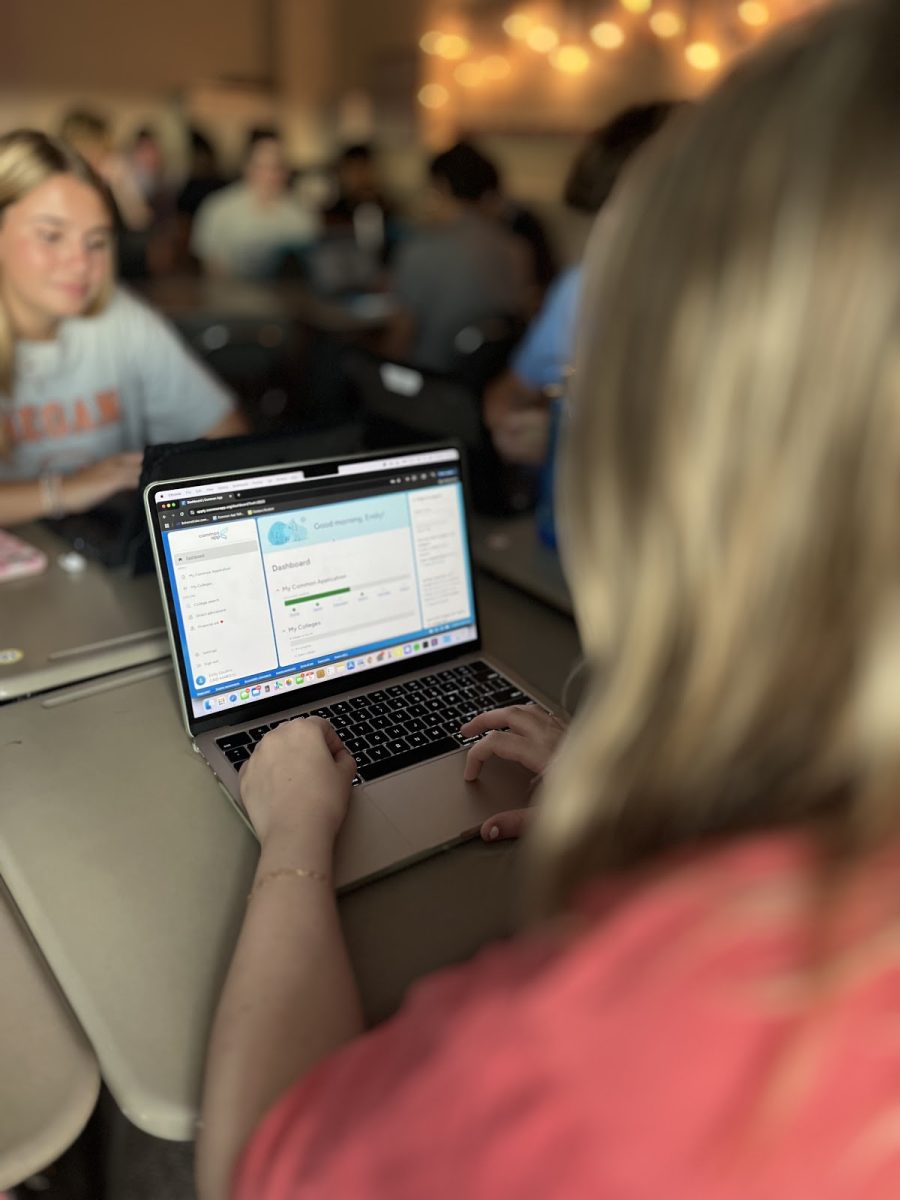

One of the main positives of the Triangle area is its easy access to three great colleges: NC State, UNC Chapel Hill and Duke. But for the students at these colleges who, in the years after they graduate, will need to find a place to live, these higher prices will pose an issue. Shea Sullivan, a student at Chapel Hill, discussed how it wasn’t realistic for her to even look at purchasing a house with the current market. “I don’t think I will buy a house for at least 15 years,” she stated,” I would probably consider that when I’m about 32.”

Sullivan then elaborated on how, in her field, other costs set her back as well, putting housebuying far out of reach. “Some people in business fields might be closer to that point after graduating college, but for medicine, definitely not.” Additional costs of education, living expenses and more are just another drop in the bucket in the long list of reasons that make it difficult for first time homebuyers to find something affordable.

Housing prices have increased drastically over the last couple of years, with the national average reaching an all time high of $363,505, according to digital real estate platform Zillow. The average single American makes anywhere between $60,000 and $80,000 a year, and a down payment can range from 3%-20% of the home price. Kindell also described the impact increasing mortgage rates is having on the number of first-time buyers. “Home prices have risen dramatically since the pandemic, and mortgage interest rates have increased, which causes the monthly payments to be more significant for those who already have a tight budget.” Apollo, an alternative asset management and retirement service, reported that mortgage rates are close to 7%, which totals a sum of around $25,000. With prices this high, first-time buyers are shy to purchase a home outside of their budget. Despite these high prices, demand for homes is still outpacing supply.

The housing market works on a schedule of supply and demand. When demand increases and supply cannot keep up, prices for the product also increase. The National Association of Homebuilders reported that there is a nationwide shortage of 1.5 million housing units, which increases the prices for consumers. In the Triangle, homeowner vacancy rates are less than 1%, indicating a severe undersupply. Additionally, the homes that are available aren’t always ideal for first-time buyers. Kindell noted that, “There are also fewer “starter homes” available for first-time buyers,” which can also make those who are interested in buying a house decide to put the purchase on hold. Despite many looking to buy, many are not taking the jump due to the undersupply of available units. When demand is higher than supply, like it is in the Triangle, inflation in the housing market occurs.

Inflation is the rise in price of goods and services over time, meaning money can’t buy as much as it used to. Inflation can increase the costs of products to build the house, increasing the total cost of the home, and subsequently making it more expensive for the consumer. For individuals and families, inflation can take away money from savings as more money must be spent on essentials. “Overall prices for goods, such as food and utilities, have increased significantly, making it more challenging to save for a down payment or closing costs,” explained Kindell.

The increase in urbanization is also contributing to the decrease in first-time homebuyers as the demand for houses in areas with developed industries attracts workers, thus leading to higher home values. Currently, over half the world lives in urbanized areas. The amount of people living in urban areas outreached rural area populations in 2007, according to Our World in Data.

Urbanization usually increases when there are more job opportunities available in that area to attract more workers. When there are more employment opportunities in the area and urbanizations increase, this drives up the home values in surrounding areas to match the worker influx. This can be seen in Durham County, where the median home value has increased by 58% since 2019. This is likely due to the Triangle area, which includes Durham County, continuously being marketed as a hotspot for many industries. Workers are flocking to the area, causing a rise in home value that leads to higher property taxes prospective home-owners can’t afford.

With a variety of economic factors working against first-time home buyers, it’s critical that the real estate industry works to come up with ways to support this struggling group. Kindell encourages those who are interested in buying a home to find an experienced realtor and mortgage broker to assist them in the process. She also believes that more financial assistance needs to be provided so that they can afford to buy houses, such as expanding the already existing tax-credits for first time buyers. “There can also be incentives provided to expand the construction of entry-level homes with zoning reforms, tax credits, or subsidies,” she added. For younger individuals looking to buy a house, student loan relief would also be helpful as it would free up extra income to put towards the property.

It’s clear that today’s economy presents many challenges for those looking to buy a house for the first time. Higher house prices, inflation, decreased supply and increased home values as a result of urbanization have all contributed to the fall in first-time homeowners. The trend is prevalent across the U.S. and in the Triangle area, meaning that steps must be taken to allow prospective buyers the opportunity to purchase a house.